|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

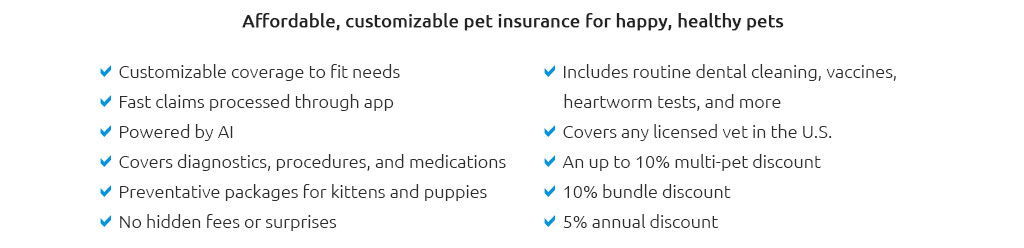

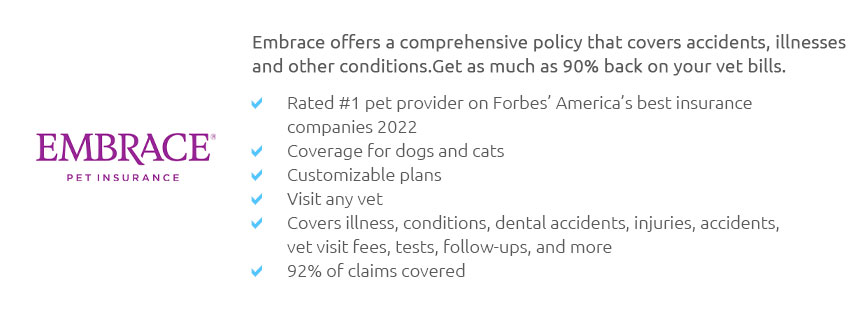

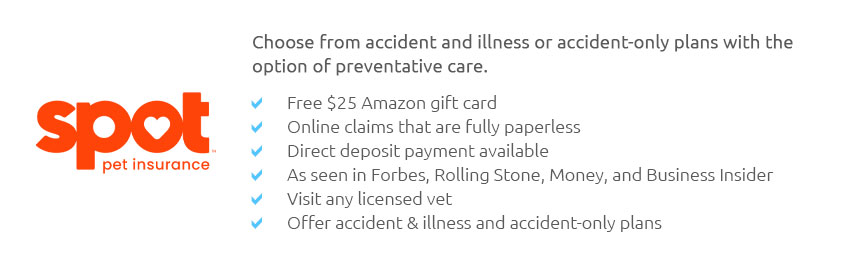

Understanding Animal Insurance Coverage: Things to ConsiderIn the ever-evolving landscape of pet ownership, the topic of animal insurance coverage has become a subject of significant interest and importance. For many, pets are not just companions but integral members of the family, deserving of the same level of care and protection as any other family member. Thus, the idea of insuring these beloved creatures has gained traction, leading to a burgeoning market of options and considerations. As a prospective policyholder, it’s vital to navigate this complex field with an informed perspective. At its core, animal insurance is designed to alleviate the financial burden associated with veterinary care. While some may perceive it as an unnecessary expense, especially if their pets are young and healthy, others recognize it as a prudent investment, providing peace of mind against unforeseen circumstances. The scope of coverage can vary significantly from one policy to another, making it imperative to understand the nuances and tailor a plan that aligns with your specific needs and the needs of your pet.

In conclusion, while the landscape of animal insurance coverage is intricate, taking the time to delve into the specifics can yield a plan that offers both protection for your pet and financial security for you. The key lies in striking a balance between comprehensive coverage and affordability, ensuring that your furry, feathered, or scaled family members are safeguarded against life’s uncertainties. As the saying goes, it is better to have it and not need it than to need it and not have it, a sentiment that rings especially true when it comes to the well-being of our cherished animal companions. https://www.progressive.com/pet-insurance/

A deductible and copay are applied to claims. Policyholders have the option of an annual coverage benefit of $5,000, $10,000, or $20,000. You can cancel ... https://www.lemonade.com/pet

Lemonade Pet works on a reimbursement basis. You'll pay the vet bill up front, and then you can immediately file a claim on the Lemonade app. Once it's approved ... https://www.nerdwallet.com/article/insurance/pet-insurance-coverage

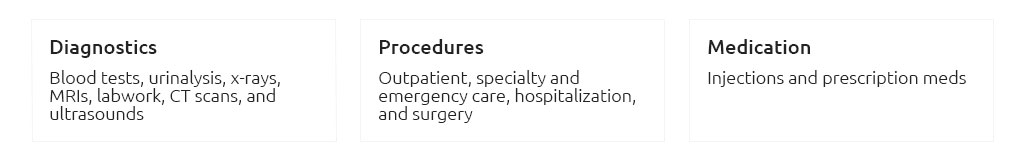

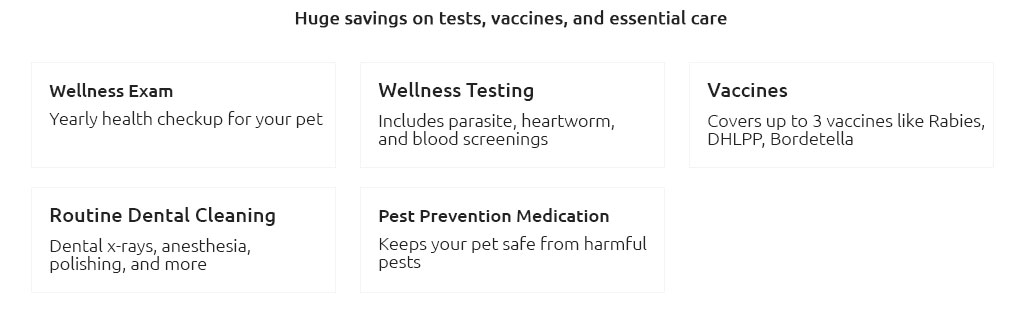

Pet insurance covers medicine, diagnostic tests, hospitalization and other expenses if your pet gets hurt or sick.

|